Advertisement

The price of gold is at an all-time high. But should you buy it right now? Find out more later in this email.

💵 Today’s Top Stories

Kleenex cylinders perfect for your car, a Valentine’s Day LEGO set and a pump-activated salad spinner are among the cool new products Costco locations offer this month. Read more.

U.S. News & World Report just issued its category awards for the best cars based on price, five-year ownership cost, safety ratings and more. Read more.

A Team Clark member is a happy Amica insurance customer. But she wanted to pay less. Her and her husband made these three changes and saved $1,600 per year. Read more.

The NBA trade deadline just passed with some blockbuster moves including Luka Doncic and De’Aaron Fox. Here’s how to watch your team without cable as we move toward All-Star weekend. Read more.

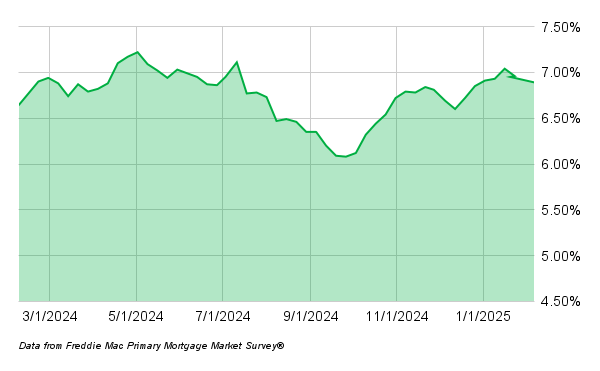

🏠️ Today’s Current Mortgage Rates

According to Freddie Mac, 30-year mortgage rates are 6.89% and 15-year rates are 6.05% as of February 6, 2025. The following chart shows the 30-year mortgage rate trend over the last year.

🥇Should You Buy Gold Right Now?

With tariffs in the headlines most of 2025, gold prices continue to break all-time highs.

Gold sat near $2,000 per ounce at the beginning of last February before soaring to more than $2,850 per ounce last week.

Along with tariff headlines, the U.S. dollar fell 0.9% last week, making gold cheaper for those that hold other currencies.

The narrative around gold is that it’s a hedge against inflation and political uncertainty. But the higher interest rates are, the less attractive gold is, as it doesn’t offer any yield (like, say, a high-interest savings account or CD).

Still, gold has beaten the S&P 500 in returns since 2000. Why not go all in with your investment?

Not so fast! Clark says buying precious metals such as gold and silver “are not investments.”

Clark says it’s OK to hold up to 5% of your portfolio in gold. Here are his three other rules if you’re going to buy:

Don’t physically hold the gold due to costs, large bid/ask spreads and needing to store it.

Buy through an ETF or ETN with an expense ratio of 0.25% or less (examples: IAU, BAR, SGOL and GLDM).

Make sure you aren’t basing your purchase on a “gloom and doom” theory about the U.S. and the economy.

📊 Stat of the Day

🏈 22.6 million: Number of Americans not expected to make it to work today after Super Bowl LIX. That’s up from 16.1 million last year. The top reasons: pre-approved absence (8% of the overall workforce), go in late (8%), swap shifts (3%), call in sick (2%) and ghost (2%).

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

It’s time for "Clark Stinks!" Christa reads the latest "Clark Stinks!" submissions and Clark responds. Also, temperatures have been cold across the United States, and energy bills are up, up, and away. But it’s more than winter weather causing this increase. Clark explains what’s going on and how we should help our neighbors if they can’t afford their bill.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.