Today’s Sponsor

💵 Today’s Top Stories

Christmas clearance items, TVs, exercise equipment and travel are just some of the items on sale this month. Read more.

Saving for a house, car or another big item? Clark explains whether you should invest your money, stash it in a savings account or do something else. Read more.

Get one line of unlimited 5G for just $25/mo guaranteed for 5 years. Taxes & Fees included in the price.

Do you have the right number of credit cards? Should you close old cards? And how can you pay as little as possible in interest? Read more.

The average traveler spends 30 hours researching and visits 38 websites before making a reservation for a big trip. Here are the times when hiring a travel agent makes sense. Read more.

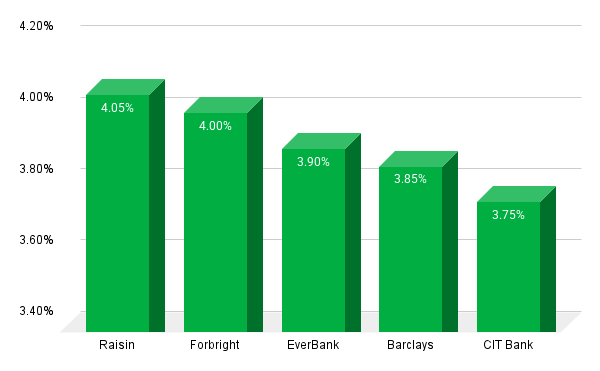

💵 Today’s Top Savings Rates

Check out our updated list of Clark.com-approved high-yield savings accounts with the highest rates. Here are the top five APYs on our list as of January 1, 2026.

🏠 The Cost of Buying a Home in 2026

Is 2026 finally the year you buy a house?

If you missed the historically low mortgage rates pre-COVID and have been sitting on the sidelines, you may finally land on more reasonable rates.

Don’t expect to find anything in the 2s or 3s, as was common just a few years ago. But as of early this week, 30-year fixed mortgage rates averaged 6.25% and 15-year fixed rates averaged 5.58%.

That could come down a touch further if we get a few more Fed interest rate cuts.

But how much money will you really need to buy, say, a $500,000 house? That’s just above the Q2 national average of $410,800 and the subject of a recent Kiplinger article.

Assuming 20% down ($100,000) and a 6.5%, 30-year fixed mortgage on the remaining $400,000, the calculator Kiplinger used came to a monthly payment of $3,666 including utilities, taxes and insurance.

“To afford this mortgage, your monthly income would need to be $12,200, or you’d need a salary of about $146,640,” Kiplinger concluded.

The article also listed some key variables that can make the number go up or down for your specific circumstances.

Clark recommends a 15-year mortgage for anyone who can afford the payments.

Wondering how much house you can afford? This guide can help.

📊 Stat of the Day

🤖 1,300+: Approximate number of AI startups that have raised money at valuations of at least $100 million, including 498 with valuations of $1 billion. Overall, AI startups attracted nearly $200 billion in VC money from January to September.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

Protect your wallet and stop getting ripped off. Subscribe to Clark Howard's channel now for free, actionable money-saving advice every day.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.