Advertisement

Later in this email, Clark explains why you shouldn’t “just say yes” to huge insurance premium increases.

💵 Today’s Top Stories

Stop wasting so much of your paycheck on medication. These half-dozen pharmacies fill some prescriptions for less than $5. Read more.

Clark’s three favorites haven’t changed. But they’re not perfect. And Clark points out flaws when he sees them. What are the best investment companies in 2024? Read more.

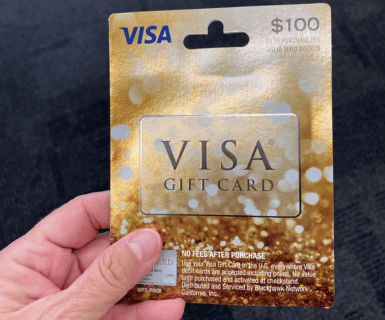

Never buy gift cards from a rack at a retail store, Clark says. Here’s how criminals are draining Visa gift cards without notice. Read more.

Even Clark, an EV driver for 14 years, doesn’t think renting an EV in Europe sounds like much fun in 2024. But he reveals the year he thinks it will be much smoother. Read more.

🏠 Today’s Current Mortgage Rates

According to Freddie Mac, 30-year mortgage rates are 6.94% and 15-year rates are 6.26% as of February 29, 2024. The following chart shows the 30-year mortgage rate trend over the last year.

🚘 These Auto Insurance Increases Can Dent Your Budget If You Allow It

The fact that auto and home insurance premiums are reaching unfathomable levels isn’t new.

However, the exact numbers are shocking.

State Farm just suffered a net loss of $6.3 billion in 2023 after losing $6.7 billion in 2022. It’s no wonder these companies are getting aggressive about finding more revenue.

The average auto insurance increased by 20.3% in 2023.

Remember, states regulate the rate increases that insurance companies are allowed to pursue. According to Clark, a lot of state insurance departments are “captive regulators” who “are not impartial … they’re allies of the insurance industry.”

Recently, the L.A. Times reported on the following approved average premium increases for auto insurance in California:

Allstate: +30%

State Farm: +21%

Geico: +12.8%

“The numbers are from California. It will vary state by state. But it’s a proxy for the country,” Clark says.

“You can have no at-faults and no changes to your driving record and you can have an increase as high as 55% at Allstate.”

The entire industry is facing the same trend. But not in equal intensity. So remember you’re not a sitting duck and comparison shop if your insurance provider wants you to swallow a giant price increase.

📊 Stat of the Day

💸 $1.8 million: Illegal stock gains that a BP manager’s husband made when working from home and eavesdropping on his wife’s work call about an upcoming acquisition. His wife was unaware but got fired anyway. She divorced him and he faces up to five years in prison for insider trading in addition to fines.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

It’s time for "Clark Stinks!" Christa reads the latest "Clark Stinks!" submissions and Clark responds. Also, there are a lot of ways to book a hotel: direct, third-party sites, credit card travel portals, etc. Clark is seeing an increase in booking issues in one of these options and shares everything you need to know before you plan your next trip.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.