Advertisement

The U.S. market outlook is uncertain. Find out what Clark has to say later on in this email.

💵 Today’s Top Stories

It’s a great time to buy bikes, patio furniture and linens. But don’t forget about food. It’s almost Cinco de Mayo and National Hamburger Day comes later this month. Read more.

The government just updated its Series I savings bond rates for the next six months. Here’s the new combined rate for May through October. Read more.

MasterCard and Visa just settled a “merchant swipe fees” antitrust lawsuit for $30 billion. Could this be the beginning of the end for credit card rewards as we know them? Read more.

Pop quiz: Which method helps you pay off your credit card debt faster, one monthly payment or three smaller payments spread throughout the month? Read more.

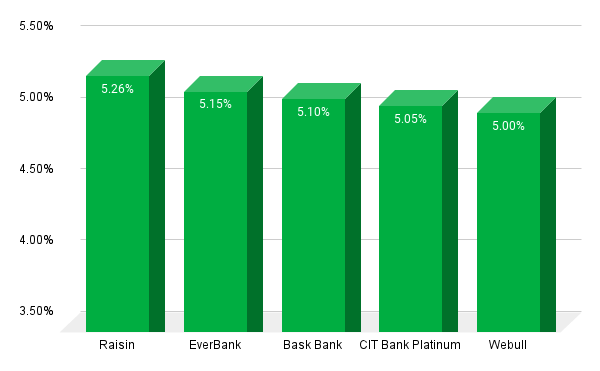

💸 Today’s Top Savings Rates

Check out our updated list of Clark.com-approved high-yield savings accounts with the highest rates. Here are the top five APYs on our list as of May 1, 2024.

💵 Clark’s Advice Amid Stock Market Uncertainty: Stay Invested

It’s easy to stay consistent with your long-term retirement investing when stock prices rise and rise and rise.

Right now, though, the U.S. market outlook is uncertain. Two weeks ago, it was enough to push the Fear & Greed Index to a score of 32 out of 100.

The scale operates in four tiers: Extreme Greed (75-100), Greed (50-75), Fear (25-50) and Extreme Fear (0-25). Here’s a sampling of headlines:

Is a market correction coming? (U.S. Bank)

Clark acknowledged in recent weeks that stocks generally are valued at historically high multiples right now. And that there’s some short-term pessimism about the market in some circles.

Now is a great time to remember Clark’s timeless investing advice. Saving for retirement is a decades-long game. And he considers a timeline of 10+ years to be true investing.

The bottom line? Pulling your money from the market in times of volatility and uncertainty often is the worst possible decision. Because most of the stock market gains come on very few days of trading, often on the heels of poor performance.

He’s a fan of automatically investing a percentage of each paycheck. In other words, dollar-cost averaging.

“As long as you are invested for the right reasons – saving for your long term – and your money is diversified in a way that’s appropriate to your age, just ignore the headlines and hang in there,” Clark says.

📊 Stat of the Day

🪫 123: Increase in the number of public fast-charging EV stations in the United States in the first three months of 2024. “Quick-turn EV stations” now represent one in every 15 gas stations. Tesla controls more than 25% of the more than 8,000 stations.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

We have an unprecedented housing market problem in the United States. Many home owners have ultra-low mortgage rates and are unwilling to move because rates are so unfavorably high to buy different property. This is leading to incredible distortion in the market. Clark has an out-of-the-box idea that could solve this issue. Also, when you book a flight, do you check the flight number? If it’s four digits, it’s likely a “code share” ticket and it could potentially cause trouble during your trip. Clark explains how code share flights work and what you need to know before your next vacation.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.