Advertisement

Curious to know the components that the U.S. government uses to gauge inflation? Find out about this and more later on in this email.

💵 Today’s Top Stories

The average age of vehicles in the U.S. is higher than it’s ever been. Find out if your car hits the mark. Plus, Clark’s special rule for achieving the financial and safety sweet spot. Read more.

Dumpster diving and using a disposable razor for a year are just some of the extreme ways you can save money. Read more.

From fake prize notifications to packages you never ordered, here are some common Amazon scams, how to avoid them and what to do if you stumble into one. Read more.

We just reviewed PureTalk, a prepaid cell phone provider on AT&T’s network that offers competitive prices and fair amounts high-speed data. Read more.

📈 5 Biggest Risers and Fallers in CPI (Inflation Index)

Inflation is a litmus test at this point.

Optimists will underline how much better things have gotten since the 9.1% high-water mark in June 2022.

Pessimists will remind you that the Fed’s stated goal is 2.0% annual inflation. And that we reached 3.0% in June 2023. In the 12 months since, it has ranged between 3.1 and 4.1% instead of trickling toward that 2%mark.

Still, it’s interesting to break down the individual components of the Consumer Price Index [CPI], the index that the U.S. government uses to gauge inflation.

Here are the five elements where prices are increasing most year-over-year as of the new CPI for May:

Sporting event tickets: +21.7%

Auto insurance: +20.3%

Transportation services: +10.5%

Auto repair: +9.5%

Hospital services: +7.2%

The Bad: Auto insurance continues to shred budgets across America. But if you like going to sporting events, you’ll pay out even more. Just hope your car doesn’t break down on the way.

And here are the five elements where prices are decreasing most year-over-year:

Used vehicles: -9.3%

Car rentals: -8.8%

Toys: -7.8%

TVs: -6.6%

Flights: -5.9%

The Good: It’s a great time to go on a summer vacation. Airline tickets are down almost 6% year-over-year and rental cars are down almost 9%. TVs continue to get cheaper over time as Clark likes to point out.

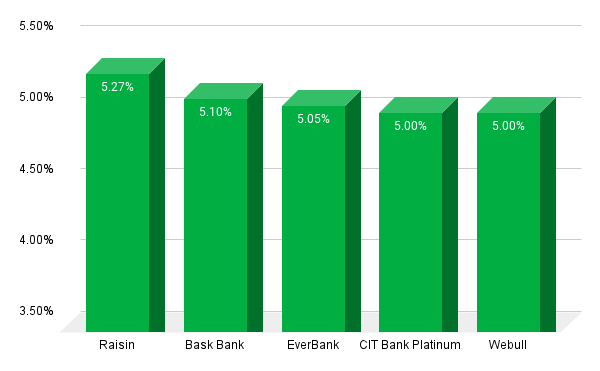

💸 Today’s Top Savings Rates

Check out our updated list of Clark.com-approved high-yield savings accounts with the highest rates. Here are the top five APYs on our list as of June 19, 2024.

📊 Stat of the Day

💵 $2.8 billion: Losses incurred by “buy now, pay later” giant Affirm since 2019. The firm registered a single profitable quarter during that period. Affirm has landed some giant partnerships – most recently with Apple Pay – but it’s unclear for how long the company can burn money. That may be music to Clark’s ears, as he’s long despised the buy now, pay later model.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

Auto theft is a huge crime, and thieves are getting more clever. It’s almost too easy for criminals to steal your car – even from your own home. Luckily, there’s a cheap way to protect your vehicle! Also, the number of legitimate work-from-home job opportunities are up from 2019, but there has been a slight decrease over the last few years. The job market doesn’t have enough remote listings to meet the demand, and criminals see an opportunity. If you’re looking for remote work, Clark shares the red flags you need to know so you pursue the right opportunities for you.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.