Advertisement

Have you ever heard of retail investing? It is more popular than ever, but what does it entail? Find out more later in this email.

💵 Today’s Top Stories

Did you know you can access the T-Mobile network while paying basement prices? Here’s the cheapest overall plan, unlimited plan and the best hotspot plan among those networks. Read more.

These credit cards are now offering a chance at three free months of Instacart+ subscription. Here’s who’s eligible. Read more.

Cash-value gift cards can be annoying or wasteful when they don’t allow you to charge beyond the remaining value and pay the difference out of pocket. Here’s how to spend the last of the money. Read more.

Clark got 22% back on a summer cruise he booked just because the prices dropped. Here’s how he got the cruise line to put money back in his bank account. Read more.

🛍 Retail Investors Become More Important Than Ever

“Retail investors” used to be a disparaging term among industry professionals, similar to “fish” at a poker table.

Square money that made it easier for the sharks -- hedge funds, investment companies, exchanges and more – to get richer.

A few years back, a few Reddit users in a countercultural investment forum noticed that GameStop was extremely overbought. The resulting short squeeze led to a stock price gain of about 1,500% and shook a few hedge funds to the core in January 2021.

It appealed to many every-day investors as an opportunity to strike back against The Man in the investment industry, even if it was short-lived.

But perhaps it was a canary in the coal mine, or at least a harbinger. Retail investors reached a record 36% share of the stock market in late April according to JPMorgan.

“This is more than TRIPLE the 10-year average of 12%,” Adam Kobeissi wrote on May 17. “Retail investors have bought a record $50 billion in equities since April 8. Retail is stronger than ever.”

At one point, institutions sold $1 trillion on stock shares for the year. At the same point, just 3% of Vanguard 401(k) investors made trades in April. When the stock market dipped at the onset of tariff announcements, retail traders swarmed to “buy the dip.”

It’s even more reason to follow a sound, emotionless investment plan, as retail investors and traders can make bull runs or downturns even more extreme and decisive.

💸 Today’s Top Savings Rates

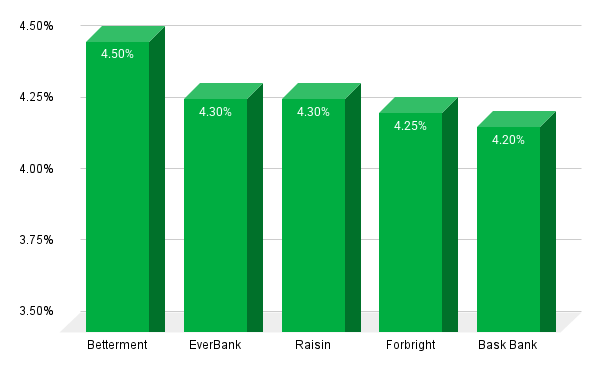

Check out our updated list of Clark.com-approved high-yield savings accounts with the highest rates. Here are the top five APYs on our list as of June 4, 2025.

📊 Stat of the Day

📈 98: The U.S. consumer confidence index score in May. That’s up from 86 in April and well above what economists expected. The expectations index also experienced its largest month-over-month increase since May 2009.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

Should you own gold? How much should you own? Fiduciary financial advisor Wes Moss breaks down the data and shares his take on investing in gold to help you determine if it belongs in your portfolio. Also, the CEO of a major AI company recently said that 50% of all entry-level white collar jobs will go away over the next 1-5 years. Could this prediction be right? It’s possible. Wes explains what may happen and what we can do about it.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.