Advertisement

💵 Today’s Top Stories

Wells Fargo is no longer a criminal enterprise impersonating a bank, Clark says in a notable about-face. Here’s what’s changed and why he’s cautiously optimistic. Read more.

A man is about to retire and wants to know whether to take a one-time payment or a monthly pension. Here’s what Clark says – and whether the man should pay for a financial advisor. Read more.

Save on your cell phone bill by switching to an MVNO on AT&T’s network for as little as $8 per month. Read more.

This credit card overhauled its rewards program in April. Here’s why we no longer believe this card is a good fit for new customers. Read more.

💸 Today’s Top Savings Rates

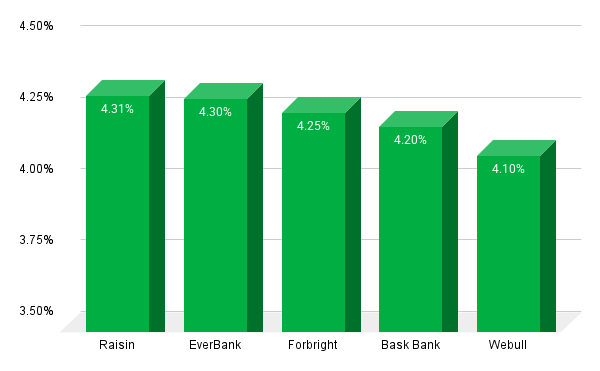

Check out our updated list of Clark.com-approved high-yield savings accounts with the highest rates. Here are the top five APYs on our list as of July 23, 2025.

👶 Federal Government Offers Babies $1,000 To Invest

Babies born this year through 2028 will get a financial boost from the federal government.

They’re now eligible to receive $1,000 through a “Trump Account,” part of The One Big Beautiful Bill Act.

Call it a baby version of a 401(k). A child must have a Social Security number to open an account.

In addition to the $1,000 from the federal government (2025-28 babies only), parents and relatives can contribute up to $5,000 annually until the child turns 18. Parents’ companies can also contribute.

According to FOX, the money “must be invested in low-cost stock mutual funds or exchange-traded funds like the S&P 500.” And the child can access the money for certain purposes as young as 18 (education, buying a first home and starting a business, for example).

Wrote Investopedia: “The IRS and regulatory guidance have yet to clarify the final rules on how withdrawals will be taxed. Some sources suggest only the gains – not the initial contribution – will be taxed as regular income, while others propose they will be taxed as capital gains.”

📊 Stat of the Day

🇺🇸 323: Number of S&P 500 companies that are registered in Delaware, which always has been extremely friendly in terms of corporate law. However, that long-term status is running into turbulence. Maryland (21), New York (12), Ohio (12) and Virginia (12) are next. Surprisingly, California claims just four.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

Are you falling for common financial myths that are holding back your wealth? Fiduciary financial advisor Wes Moss debunks 10 prevalent financial misconceptions that could be costing you big time!

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.