Advertisement

Are you upside down on your vehicle loan? Find out what Clark has to say later in this email.

💵 Today’s Top Stories

You can’t fall for a phone scam if you don’t … well, we’ll allow Clark to finish that sentence. He explains how to avoid common phone scams with one simple rule. Read more.

Follow Clark’s No. 1 rule to rack up instant savings every time you buy batteries. Clark.com reveals the cheapest sellers and the best places to find deals. Read more.

Clark hates debt. But he wants you to prioritize your retirement first. Here’s when you should save for your next vehicle. Read more.

You can get 2% cash back that goes straight into a retirement or brokerage account. You can also get rewards that go toward 529 plans or savings accounts. Read more.

The features include new international travel perks, increased hotspot speeds and more. If you’re looking for a new cell phone plan, read this! Read more.

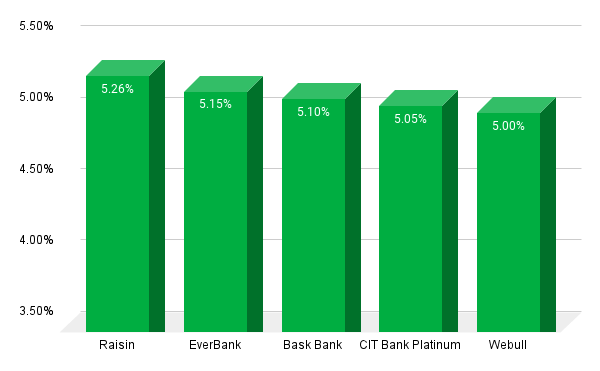

💸 Today’s Top Savings Rates

Check out our updated list of Clark.com-approved high-yield savings accounts with the highest rates. Here are the top five APYs on our list as of March 27, 2024.

🚘 Upside Down on Your Vehicle Loan? Resolve To Keep Driving It

The trickle-down effect of COVID on the car market continues to hit wallets even as vehicle prices are moderating.

New and used vehicle prices went up sharply as supply chain issues threw off the normal supply-and-demand balance.

As such, buyers purchased vehicles at all-time high prices. If they financed, especially on a lengthy loan, they’re getting stung now as the value of their vehicle depreciates.

More than 20% of trade-in vehicles on new car sales had negative equity in the fourth quarter of 2023. In other words, 1 in 5 people were upside-down on their vehicle. And by a record-high average amount of $6,064.

Say you trade in a vehicle on which you owe more than it’s worth. You now roll that negative equity into your loan for the new vehicle. And you’re paying for the new car and the old car at the same time.

“As much as you’d like those newer wheels or brand new wheels, if you’re upside down on a loan, you keep driving what you got,” Clark says. “Cars are so much more reliable than they used to be.

“Today nothing but trouble starts more often at 200,000 or 250,000 miles on the odometer. Even if you’re tired of it, it’s not necessarily tired of you. And the best answer with negative equity is to keep driving.”

📊 Stat of the Day

🥤20,000: Subway locations that will switch from Coke to Pepsi products starting in January 2025. In other words, Pepsi stole Coke’s largest client. It’s not all one-way traffic, though. Skyline Chili (next month) and Culver’s (January 2023) switched from Pepsi to Coke.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

Health providers and insurers are in a nearly constant battle. If you think your doctor is still in network, Clark shares a really important tip you need to know before your next appointment. Also, Dollar General is back in the headlines and it’s not so positive. Clark explains why it’s so important to treat employees well.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.