Advertisement

📣 We Need Your Help!

Want to see more of our content when you have a question about money, scams, or saving? A quick update to your Google preferences can make a big difference. It tells Google you want to see more content from Team Clark in your search results, making it easier to find well-researched, trustworthy answers to your questions. Note: You need to be logged in to your Google account first.

💵 Today’s Top Stories

Even if you’re not using a credit card, don’t stash it in a drawer and forget it or cancel the card. Do this instead so you keep your credit score as high as possible. Read more.

Paying cash for a vehicle? Conventional wisdom says don’t tell the salesperson at the dealership. But what do you do if they ask? Read more.

Take the devices you have sitting in a drawer and put them to good use. Get inspired by these ways to give life to your old tech. Read more.

Costco delivers an exceptional tire-buying experience. And the service doesn’t stop with the sale. Is it competitive on pricing? Read more.

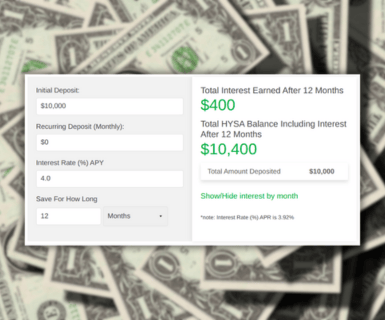

💵 Calculator of the Week: High-Yield Savings Account Calculator

This calculator helps you see the power of a high-yield savings account by showing you exactly how your money can grow over time. Just plug in your deposits and the interest rate to watch your potential earnings add up!

🚘 Americans Playing Dangerous Games With Auto Loans

Clark’s advice on vehicle loans is more important than ever.

Clark is also big on driving your vehicle for longer if it still runs well rather than initiating a new, unfavorable loan or trading in a vehicle when you still owe more than it’s worth. Though utilizing shorter term lengths tends to root out a large portion of underwater vehicles.

Many Americans are not listening at the moment.

According to stats aggregated by Car Dealership Guy, seven-year auto loans now make up 21% of the market. That’s 84 months, twice as long as Clark’s maximum(!).

Subsequently, the loan-to-value ratios (LTVs) are murky at best.

In Q2 of 2022, 38% of auto loans were 120%+ more than the vehicle was worth and 17% were 140%+ above the vehicle’s worth.

In Q2 of 2025, those numbers skied to 53% and 17%.

“LTVs signal how much risk lenders and dealers are taking on,” Car Dealership Guy said. “And when they soar, it leads to tougher loan approvals, tighter lender underwriting, and greater chance of losses if things go wrong.”

Alarmingly, 26.6% of customers trading in vehicles right now are underwater (worth less than what they owe), a four-year high. They owe $6,754 on average.

Following Clark’s advice on term lengths and driving your older vehicles for longer can do a lot to alleviate those financial headaches.

📊 Stat of the Day

💳 $8,424: Average household credit card debt in Wisconsin, the least indebted state on average. On the other end of the spectrum, the average Hawaiian household owes $15,052 to credit card companies.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

The financial world is an "F" game when it comes to protecting your money. Clark reveals the multi-factor authentication scams criminals are using to empty your bank accounts and how to protect yourself. Also, he discusses how to succeed in a changing workplace and future-proof your career in the age of AI.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.