Advertisement

💵 Today’s Top Stories

If your neighbor’s tree falls and crushes your property, you may be legally responsible. Here’s what Clark says you need to do if it looks like that may happen. Read more.

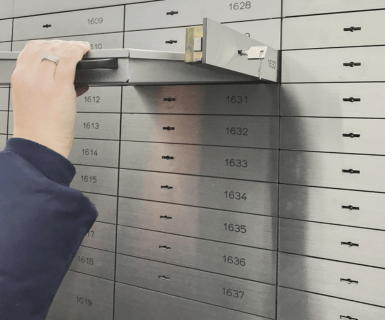

If you want to keep your valuables safe, you may want to secure them in the same place Clark does – and that’s NOT in a bank safe deposit box. Read more.

If you love eating at restaurants, have you ever considered applying for a credit card that can reward you better than the standard 2% cash back? Read more.

Avoid the long lines and existential dread of the post office – as well as the high in-store prices of FedEx and UPS – with this fast, cheap shipping secret weapon. Read more

💵 Fed Takes New Laissez-Faire Approach to 401(k) Investment Options

With more power comes more responsibility. But also, sometimes less is more.

That’s the conundrum of easy investing access split across two tropes.

It wasn’t great when only the rich got access to the stock market. Clark likes that free stock trading has become a reality and that almost anyone can invest in an automated way.

Institutions and red tape generate expensive fees and deter would-be investors through extra hoops.

But the more we take financial responsibility away from institutions and put it on our own shoulders, the more educated and careful we need to be.

The latest version of progress: opening up 401(k) accounts to a slew of alternative assets such as crypto, real estate, hedge funds and private equity.

Just because you can, in the future, put 100% of your 401(k) contributions into a risky and illiquid private equity investment, or into the new, unproven crypto product on the market, doesn’t mean you should.

Clark loves encouraging us to put our 401(k) investments inside a target date fund that gets automatically allocated.

If you feel compelled to take some risks rather than betting on the market as a whole, consider Charles Schwab’s “core and explore” – allocating a small percentage of your net worth to those things.

So go easy on completely rethinking your 401(k) strategy.

📊 Stat of the Day

🚘 102: Number of safety recalls Ford has issued in 2025 (with more than four months to go). That’s an all-time record for any automaker (previous: 77 by General Motors in 2014). Ford said in its Q2 earnings report that it has paid about $15.5 million per day in warranty and field service actions.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

A retired couple in their 80s has big pensions, no debt, and a significant amount of their portfolio in stocks. While traditional wisdom suggests being more conservative with age, find out why they have an “infinite time horizon,” as fiduciary financial advisor Wes Moss explains. Also, the Federal Reserve is the engine of the U.S. economy, and its decisions on interest rates have massive ripple effects, from the housing market to your savings account. With the latest inflation and jobs reports suggesting a cooling economy, Wes explains why we may be at the end of the "higher for longer" era. He also provides a critical heads-up for savers.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.