Today’s Sponsor

💵 Today’s Top Stories

Here’s why almost everyone would do well to convert your traditional IRA into a Roth IRA. And should you consider it even if you’re close to retirement (or already retired)? Read more.

A Clark listener got an offer in the mail. He realized a credit bureau sold his Social Security Number and credit profile. Is that legal? Read more.

Retirement isn’t something to fear, it’s something to own. This guide helps give you the tools to make confident decisions, steer clear of costly mistakes, and focus on what really matters: building a life that fits you.

Home prices aren’t suddenly going to become a bargain, Clark says. But we can actively search for ways to save money. Here’s how much square footage you can get in each state. Read more.

The idea of a Target rewards credit card sounds great to fans of the store. But unless you fit these three criteria, it’s probably not worth adding to your wallet. Read more.

The cell phone provider that Team Clark calls “the best” for seniors and says “stands out for its excellent customer service” is offering new customers a free month on every line. Read more.

🏠️ Today’s Current Mortgage Rates

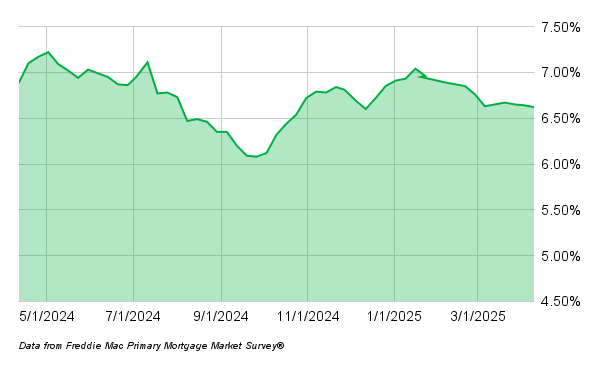

According to Freddie Mac, 30-year mortgage rates are 6.62% and 15-year rates are 5.82% as of April 10, 2025. The following chart shows the 30-year mortgage rate trend over the last year.

💳 Credit Card Networks, Banks Joust Over Apple Card

Apple launched a branded credit card in 2019 via an ill-fated partnership with Goldman Sachs.

Apple Card, designed to be used digitally through Apple Pay within the Apple ecosystem, amassed 12 million cardholders as Goldman Sachs said “no mas.”

The investment bank, not used to dealing with retail customers, wasn’t a good match for Apple, which wanted as many applicants approved as possible.

Apple dangled card rewards to get customers to buy more Apple products. But that “come one, come all” approval strategy saddled Goldman with the worst loss rate on credit card loans of all American issuers.

(Goldman temporarily pursued more retail finance customers and products, a multi-pronged strategy that it has largely abandoned.)

When customers use the card to buy Apple products, the card’s network provider – Visa, Mastercard or American Express – gets a cut of each transaction. Visa recently offered $100 million in an attempt to push aside Mastercard, setting up a battle royale between the three network providers.

In the meantime, Synchrony Financial, Capital One, JPMorgan, and other banks, more accustomed to dealing with everyday customers than Goldman Sachs, are sniffing around the program’s $20 billion in balances.

📊 Stat of the Day

🛣 604%: The increase in toll fee scam texts since the start of the year. Scammers send texts claiming people have unpaid toll fees, directing them to fake sites to collect money. SunPass and E-ZPass also joined the list of the 10 most impersonated brands in Q1.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

It’s time for "Clark Stinks!" Christa reads the latest "Clark Stinks!" submissions and Clark responds. Also, there’s a term being used to describe the job market: frozen. Clark explains what this means and predicts what he thinks will happen to jobs over the next several months, including where the opportunities will likely be.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.