Advertisement

Home inventory is returning to pre-pandemic levels. Later in this email, you will learn more about what that means for potential home buyers.

💵 Today’s Top Stories

Criminals have been squatting in houses when the owner is gone. They sometimes have legal rights and the homeowner is not allowed in their own home. Here’s how to prevent this. Read more.

Clark has consistently named three discount brokers as his favorites. But he thinks one is better than the rest for first-time investors. Read more.

Two-thirds of Americans are making a big mistake by running a balance on rewards credit cards. Here’s why they’re the wrong cards if you carry a balance. Read more.

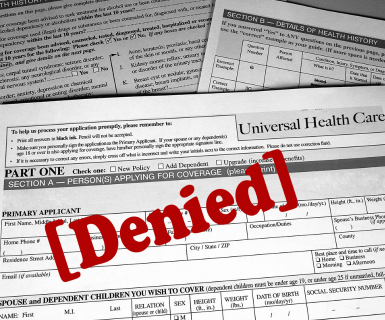

You may have no idea what to do if your health insurance company denies your claim. But don’t give up, Clark says. Here are all the strategies you should try. Read more.

🏠 Home Inventory Returning To Pre-Pandemic Levels

The factors determining home prices since before the onset of COVID-19 are numerous and complex.

But you can probably capture 80% of reality with simple “supply and demand” concepts from high school economics.

First, before the pandemic, near-zero interest rates, a long stock-market bull run and the increasing popularity of large corporations buying single-family houses as investments were just a few factors driving high demand.

The pandemic itself created pinch points in terms of building materials supply chain as well as contractors and laborers. The Fed raising interest rates from near-zero to a range of 5.25% to 5.50% changed the calculus on mortgage rates.

Those mega loans got much more expensive for buyers. And homeowners locked into historically low mortgage rates became reluctant to put their houses on the market.

That calculus finally is changing with the 0.5% rate cut. Seven states feature higher available home inventory now vs. five years ago pre-pandemic, while a few others are close.

“Generally speaking, local housing markets where active inventory has returned to pre-pandemic levels have experienced softer home price growth (or outright price declines) over the past 24 months,” the report noted.

💸 Today’s Top Savings Rates

Check out our updated list of Clark.com-approved high-yield savings accounts with the highest rates. Here are the top five APYs on our list as of October 9, 2024.

📊 Stat of the Day

📈 $206.2 billion: The net worth of Facebook co-founder and (now called) Meta CEO Mark Zuckerberg, according to the Bloomberg Billionaires Index. That makes him the second — or third-richest person on earth (depending on the source), surpassing Amazon founder Jeff Bezos. Zuckerberg’s 13% stake in Meta, which as of this writing, saw its stock appreciate 87% in the last year, has padded his wealth.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

Many of us dread and avoid conversations about death, but it’s essential to have a plan. Clark talks with Jonathan Clements, a fellow money expert and longtime friend, about his financial planning journey after receiving a terminal cancer diagnosis. Jonathan shares the true value of money and happiness, if he has any regrets, and the decisions and changes he is making to ensure his family will be financially secure.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.