Today’s Sponsor

💵 Today’s Top Stories

Junk calls are out of control again. Want to stop them? We’ve got options for you. Read more.

Be careful. Americans owe more than $1 trillion due to this increasingly-popular investing strategy that Clark considers the equivalent of gambling. Read more.

Internet crimes are accelerating at an alarming rate, with reported losses reaching a record $16.6 billion in 2024. Seniors and retirees are increasingly targeted because cybercriminals recognize their strong credit histories, accumulated assets, and predictable daily routines—making proactive protection more important than ever.

Clark gave us a simple, six-step formula to make sure you spend as little as possible on your car rental. Here’s how to save like Clark. Read more.

Want to get in shape without shelling out big bucks to a trainer or contending with the crowds at the gym? Try one of these free workout apps. Read more.

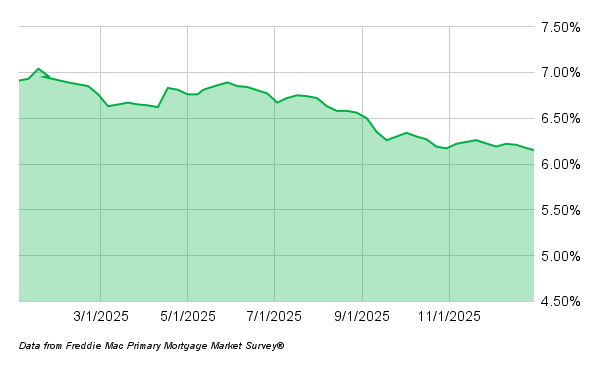

🏠️ Today’s Current Mortgage Rates

According to Freddie Mac, 30-year mortgage rates are 6.15% and 15-year rates are 5.44% as of December 31, 2025. The following chart shows the 30-year mortgage rate trend over the last year.

💵 Lessons From the Now-Retired Warren Buffett

This is the first Monday since 1962 that Warren Buffett hasn’t been in charge of Berkshire Hathaway.

The 95-year-old with a net worth of about $150 billion, despite giving away more than $60 billion in the last two decades, finally retired at the end of 2025.

He started buying shares of a New England textile mill for $7.60 almost 64 years ago. Now, shares of Berkshire Hathaway are worth more than $750,000.

Buffett likely is the most famous investor, if not one of the most successful ones.

Here are a few quick investing lessons we can all learn from Mr. Buffett.

1. Time in the market is better than timing the market.

The biggest component in the magic of compound interest: time. Preferably lots of it.

Rather than trying to get rich quick, Buffett proved the benefit of investing in a diverse portfolio – or, as Clark says, betting on the American economy as a whole – and allowing compound interest to do its thing over decades.

2. Buy low, sell high.

If it were this easy, everyone would do it.

But Buffett’s history reminds us that price matters. He was notoriously patient with cash at times when market valuations are historically high.

He missed out on some gains. But he also didn’t get hurt by “chasing” hot stocks out of greed or envy.

You can practically find Buffett’s picture next to the term “value investing” in the dictionary.

You don’t have to try to cut corners to succeed in the stock market.

3. It’s OK to be boring.

Clark constantly pokes fun at himself, almost with pride, for being such a “boring” investor. Well, count Buffett among those who share his style.

Buffett got rich investing in insurance companies, banks, consumer staples and railroads. Not flashy trends.

He prioritized low fees, long-term compounding (his favorite holding period is “forever”), avoiding panic sells when the market struggles and investing in companies he understood.

📊 Stat of the Day

🏠 +3.3%: Increase in U.S. home sales in November (vs. an expected +0.9%). It’s the largest jump since February 2023. West region homes under contract increased a nation-high 9.2% as even slightly lower mortgage rates seemed to help.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

In the first show of 2026, Clark urges you to rethink how you make buying decisions and issue a resolution to protect your personal finances from the exploding "Buy Now, Pay Later" (BNPL) trap, often marketed as "Pay in 4." Clark highlights how irresistible deals, one-click convenience, and the ease of financing are leading consumers to focus on value and debt — not just for the holidays, but as a new routine. Also, it’s time for "Clark Stinks!" Christa reads the latest "Clark Stinks!" submissions and Clark responds.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.