Advertisement

Later in this email, find out what Americans think about their personal finances entering 2024 according to a Fidelity survey.

💵 Today’s Top Stories

One bank account isn’t enough according to Clark Howard. If you’re a couple, two isn’t enough either. Here’s why – and how many accounts you should have. Read more.

Get the medicine you need at a price you can afford. Pricing for medication has become complicated, but it is possible to avoid overpaying. Read more.

Could switching to rechargeable batteries save you money? Check out our chart to see the break-even point vs. disposable batteries. Read more.

Full-size pickup trucks are the most stolen vehicles in the U.S. and cargo thefts are in the billions each year. Truck bed cameras, or “cargo cams,” are an emerging trend. Ready to buy? Clark has some tips on how to save. Read more.

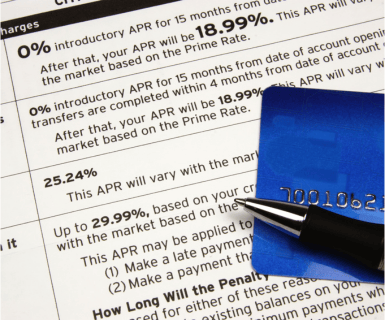

The average credit card interest rate is well north of 20%. But did you know you can get a promotional 0% APR? Here are the best cards for that temporary rate. Read more.

💵 Americans and Money in 2024: An Attitude Snapshot

Valentine’s Day is creeping closer on the calendar. Which means many of us already have broken our New Year’s Resolutions.

The gyms will start to get less crowded soon (if they aren’t already).

Still, moving into 2024 gives us an interesting picture of American’s attitudes about money. Here are some of the findings from an extensive Fidelity Investments survey:

80%: Share of Americans who claim they’ll grow their emergency fund in 2024.

79%: Share of Millennials that believe they’ll be better off financially in 2024 – the most optimistic of any generation.

70%: Number of Americans who claim to have a plan to reach their financial goals.

55%: The share of people claiming to be in a worse financial situation than in ’23 who blame inflation and cost-of-living increases.

29%: The gap between the percentage of people who stick to their financial resolutions with the help of a financial advisor (80%) and those who nail their money resolutions without one (51%).

28%: Percentage of people who would rather find love on a reality TV show than invest in the stock market.

📊 Stat of the Day

🚘 10%+: The minimum amount of range that electric vehicle batteries lose when exposed to subzero temperatures. A recent cold snap generated headlines about EV battery tech.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

Carrying a checkbook has become one of the most dangerous forms of identity theft. Clark explains the risks and why you should NEVER carry or mail a check. Also, Clark recently addressed issues with the home insurance market. There’s a new website that can help you assess the risk of a house you’re thinking about buying before you run into problems.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.