Advertisement

Later in this email, asking yourself this simple question can go a long way toward reducing your spending.

💵 Today’s Top Stories

Google and Apple have figured out a way to make you pay more when you use your phone. Here’s how Clark says you can avoid the extra expense. Read more.

You can buy hearing aides over the counter. The days of paying 30 times the price for hearing aids are over. Here are the best places to buy them. Read more.

A listener wants to wipe out $10,000 in credit card debt at an interest rate of more than 18%. Should she burn through her liquid savings or pull from her Roth IRA? Read more.

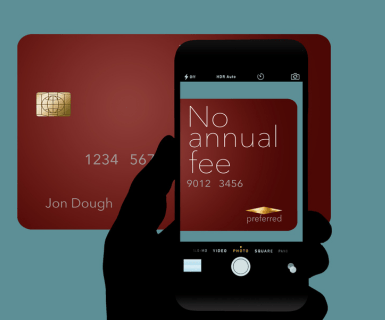

If you’re paying an annual fee for any of the credit cards in your wallet, consider a switch. Team Clark’s credit card expert offers tips on picking the right “free” card. Read more.

💸 Today’s Top Savings Rates

Check out our updated list of Clark.com-approved high-yield savings accounts with the highest rates. Here are the top five APYs on our list as of March 6, 2024.

💵 Reduce Your Spending By Separating Wants vs. Needs

The impulse to buy items on sale has only gotten harder to resist. Consider smartphones, targeted ads based on our data and data that has helped marketing teams perfect their pitches.

“What has changed is how hard it is for us to control our wants. Because the impulses to spend are everywhere,” Clark says.

He often tells people to spend less than they make. And a simple way to reduce your spending is to ask yourself for every single dollar you spend … is this a need or is this a want?

People respect Clark’s ability to make smart decisions with his own money. But even Clark can be susceptible to impulse purchases for items on deep discount.

Recently, he found a winter clearance sale. He loaded his online cart with beanies, outer layers and winter coats. Then he set aside the cart.

“Not to try to get an even bigger discount. But to think about it,” he says.

Later that day, he asked himself if he really needed those items.

“I’d put all those different kinds of items in my cart because the items were for sale up to 90% off. And there’s this thing that happens to us. It’s like endorphins from running,” Clark says.

“We see, ‘Sale, sale, sale! FINAL CLEARANCE! 70, 80, 90% off! And we’re all over it. And before you know it, you’ve bought things you don’t need.”

📊 Stat of the Day

🚗 $10 billion+: The estimated amount that Apple spent trying to develop a self-driving car in the last decade. The company reportedly is killing the project, adding importance to its “next big thing” bets on AI and VR/AR headsets.

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

More than 40% of homeowners over the age of 65 are still carrying a mortgage. There are several reasons why this is so concerning to Clark. Also, there’s a crazy story involving an airline, a customer, and a chatbot. Is chatting with bot online a safe way to resolve issues?

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.