Today’s Sponsor

💵 Today’s Top Stories

If you want to keep your valuables safe, you may want to secure them in the same place Clark does – and that’s NOT in a bank safe deposit box. Read more.

Here’s why Clark absolutely loves target date funds, the easy button for retirement investing. Read more.

Our Core Pursuit Finder helps you uncover the activities, interests, and passions that naturally energize you. In just a few minutes, you might discover a new direction worth trying.

If you’re 55+, you can switch to a cheaper provider or price-advantaged plan without sacrificing service. We studied more than 70 plans to identify the best. Read more.

Clark rarely ever recommends a narrow insurance policy. But is travel insurance an exception to the rule? And if so, how should you shape your policy? Read more.

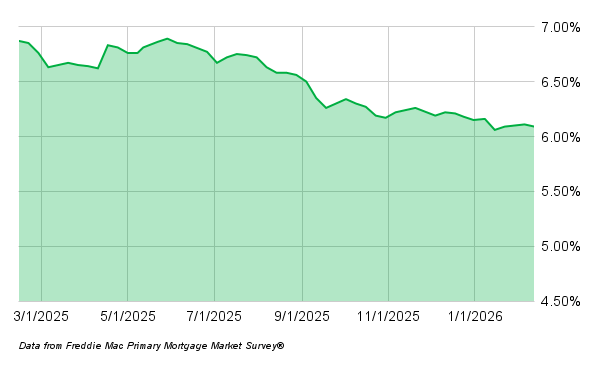

🏠️ Today’s Current Mortgage Rates

According to Freddie Mac, 30-year mortgage rates are 6.09% and 15-year rates are 5.44% as of February 12, 2026. The following chart shows the 30-year mortgage rate trend over the last year.

💰 Too Many Americans Are Living Beyond Our Means

Outside of a blip during the COVID-19 pandemic when Americans suddenly became big savers, our total credit card debt as a nation has gone up, up and away for years.

It just topped $1.28 trillion – an unfathomable number that keeps getting larger (+$44 billion in Q4 2025, +5.5% year-over-year).

The CNBC headline announcing the numbers casually dropped the term “K-shaped economy.” It’s the idea (backed by real data) that the rich are doing very well, the middle class is shrinking, and there’s a growing number of families who are struggling financially.

But then there’s this headline from the Wall Street Journal: “Americans With Higher Incomes Are Starting to Fall Behind on Payments.” Maybe it’s not just a problem facing Americans who don’t make much money.

The average client seeking help from credit-counseling agencies was making $40,000 a year and carrying $10,000 in unsecured debt before the pandemic. Those numbers are now $70,000 and $35,000.

The same report showed delinquencies are increasing as Americans fall behind on mortgage, credit card and student loan payments across different income levels.

This comes on the heels of a New York Times article expressing just how prevalent meal delivery such as DoorDash has become – often on impulse by those who can’t afford it.

Our collective debt (and delinquency rate) isn’t climbing solely because of meal delivery. But it highlights a crucial problem: spending money we can’t afford just because we feel like it or want something convenient.

Clark isn’t about spending less and saving more as some sort of financial martyrdom. He wants you to do so to unlock financial freedom in your life.

But spending less than what you make and increasing your savings over time takes intentionality.

Hopefully the plight of many of our fellow Americans isn’t your story. But it’s a good reminder to take our spending habits seriously.

📊 Stat of the Day

📺 $65: Per-month price of YouTube TV’s new skinny bundle called “Sports Plan.” It’s about $18 cheaper than the standard plan, which includes 100 channels. It includes major networks, sports channels and regional sports networks. (The first year for the sports bundle is $55 a month for new users.)

💰 Deal Alert: Today’s Top Deals

🎙 Podcast

It’s time for "Clark Stinks!" Christa reads the latest "Clark Stinks!" submissions and Clark responds. Also, the job market has been tough. What will happen in 2026? Despite the gloomy headlines, Clark offers a roadmap for resilience.

☎ Need Money Help?

The Team Clark Consumer Action Center is a free helpline that can help you navigate your money questions. Call 636-492-5275. Visit clark.com/cac for more information.